© Rocky Hill Advisors copyright 2011

OUR INVESTMENT APPROACH

RHA has perspective, independence and expertise. Our senior staff, with over 50 years of combined investment experience, utilizes a

team consulting approach to achieve unparalleled execution for our client accounts. All of our clients' portfolios are specific to their needs

and based on a unique investment plan that we create through consultation with each client. We do this in the following manner:

1.

ORGANIZE

a.

Determine the key decision makers with whom we will focus our contact.

b.

Conduct meetings with appropriate individuals to develop a full understanding of goals and objectives.

c.

Gather all relevant information related to financial goals and objectives.

d.

Review current asset holdings.

2.

FORMALIZE

a.

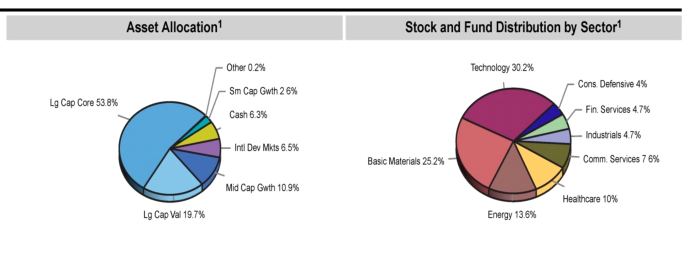

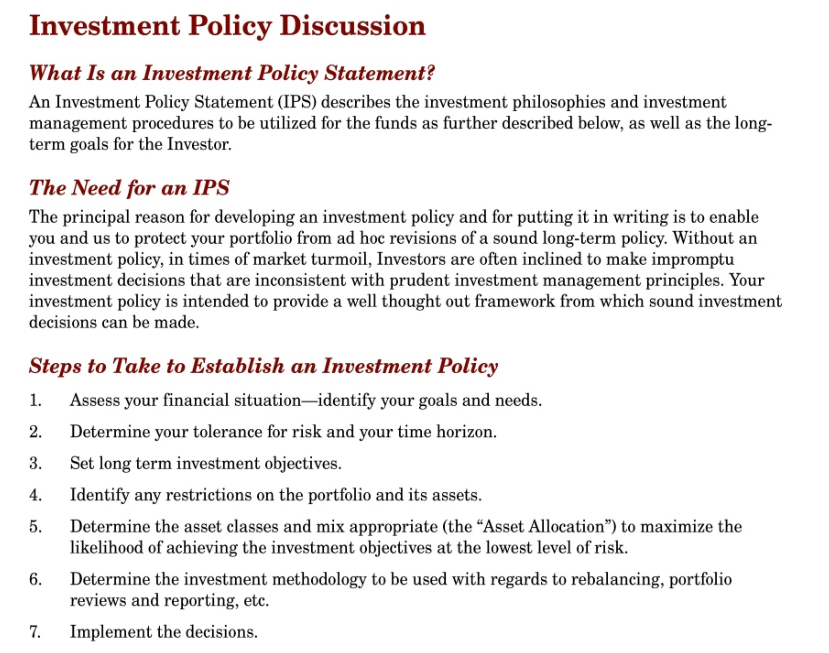

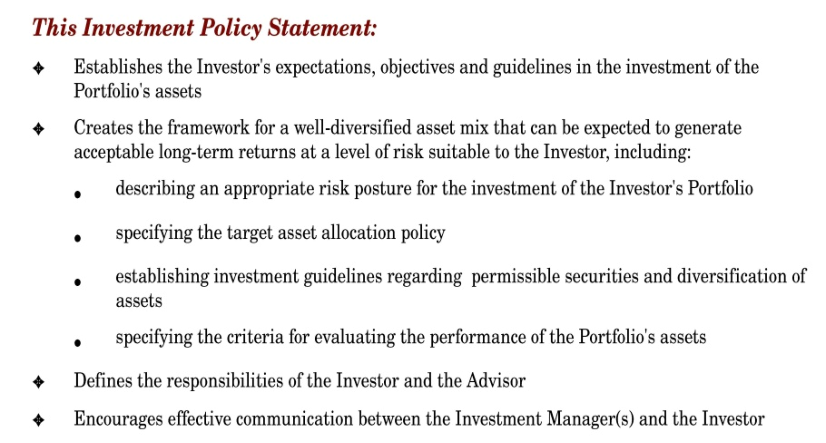

Finalize and present the written Investment Policy Statement (IPS), including targeted asset allocations.

b.

Review the IPS implementation timeline.

c.

Execute an investment contract.

d.

Formalize custody and clearing and transfer assets.

3.

INVEST

a.

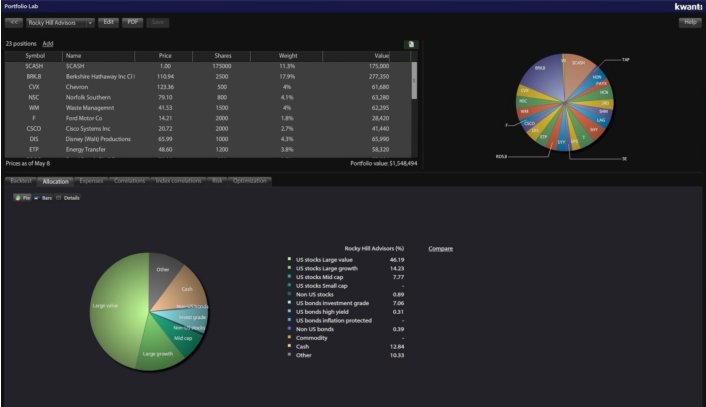

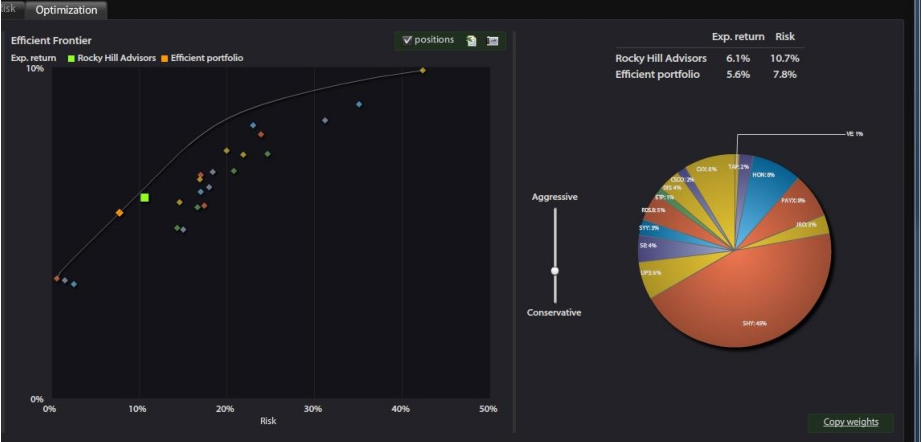

Back test, optimize and communicate investment recommendations to the client.

b.

Execute trades subject to client approval and based on the parameters of the IPS.

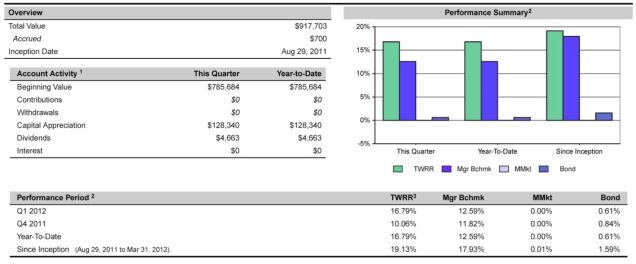

[Portfolios depicted above are purely hypothetical and are for illustrative purposes only.]

4.

MONITOR

a.

Use portfolio management tools to back test and optimize the target portfolio based on the IPS and changing market conditions.

b.

Provide client with monthly statements and quarterly performance reports.

c.

Periodically review with client to determine.

i.

Is the portfolio achieving its goals and objectives?

ii.

Have the client's goals and objectives changed

iii.

Is the portfolio aligned with the IPS?

[Portfolios depicted above are purely hypothetical and are for illustrative purposes only.]

By adhering to the above discipline, RHA is able to ensure our clients are knowledgeable about their investment portfolios and able to

hold us to the highest standards of service and performance.

RHA WRAP FEE PROGRAM

Our clients pay a single annualized fee for the services we provide in our Wrap Fee Program. Program fees are based on a percentage (%)

of the market value of all assets being managed under the program, determined as follows:

Assets Under Management

Maximum Fee

Up to $100,000

1.00%

$100,001 to $500,000

0.90%

$500,001 to $1,000,000

0.80%

$1,000,001 to $2,000,000

0.70%

$2,000,001 to $5,000,000

0.60%

$5,000,001 to $10,000,000

0.50%

$10,000,001 and above

0.40%

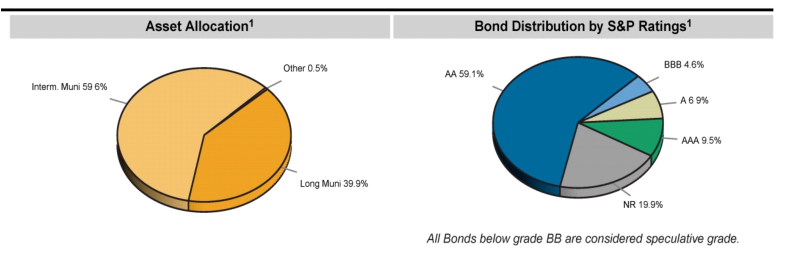

For Program participants with portfolios consisting solely of fixed-income eligible securities, RHA discounts its standard annual fee and

Program participants pay a single discounted annualized fee for participation in the Program, again based on a percentage (%) of the

market value of all of the fixed-income portfolios under management, as follows:

Assets Under Management

Maximum Fee

Up to $1,000,000

0.50%

$1,000,000 to $5,000,000

0.40%

$5,000,000 to $10,000,000

0.30%

$10,000,000 and above

0.25%